First-Time Home Buyer Guide in Toronto (2025 Edition)

First-Time Home Buyer Guide in Toronto (2025 Edition)

Key Takeaways

- Toronto remains competitive, but condos and townhomes are strong entry points for first-time buyers.

- Government programs like the First-Time Home Buyer Incentive and Land Transfer Tax rebate can reduce costs.

- Neighborhoods in Scarborough, Mississauga, Brampton, and Vaughan offer more affordable options.

- Mortgage pre-approval and budgeting for closing costs are essential steps.

- Working with a trusted realtor helps first-time buyers navigate the complex Toronto housing market.

Introduction

Buying your first home in Toronto is a huge milestone. It’s exciting, but it can also feel overwhelming with rising prices, limited inventory, and a competitive market. In 2025, Toronto’s real estate landscape continues to be one of Canada’s hottest, with condos and townhomes serving as the most realistic entry point for first-time buyers.

This guide will walk you through the essentials: incentives available, budget planning, the buying process, and the best neighborhoods in the GTA for new homeowners.

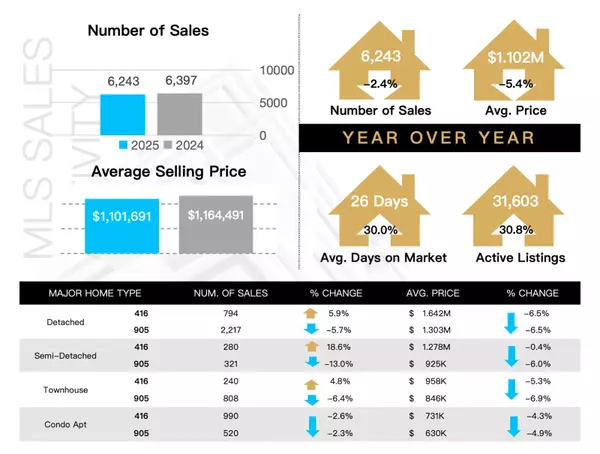

Understanding the Toronto Housing Market

The Toronto housing market is competitive, but opportunities exist for first-time buyers. Average home prices remain high, but condos and some townhomes continue to offer more affordable entry points.

- Condos: In downtown Toronto, one-bedroom condos typically start around the mid-$600,000s, while Scarborough and North York may offer slightly lower prices.

- Townhomes: More common in Mississauga, Brampton, and Vaughan, these homes provide extra space and can start around the mid-$800,000s.

- Detached Homes: Increasingly difficult for first-time buyers in the city core, but more achievable in outer GTA areas like Milton, Oshawa, or Hamilton.

If you’re curious about current MLS listings Toronto, keep an eye on neighborhoods east and west of the core for better value.

First-Time Buyer Incentives & Programs

Luckily, several programs exist to ease the financial burden of buying your first home:

- First-Time Home Buyer Incentive: A shared equity program where the government provides 5–10% of your down payment to reduce mortgage costs.

- First-Time Home Buyers’ Tax Credit: A federal tax credit worth up to $1,500 to help offset closing costs.

- Land Transfer Tax Rebate: Both Ontario and Toronto offer rebates, saving buyers up to $8,475 (Ontario) plus up to $4,475 (Toronto).

- RRSP Home Buyers’ Plan (HBP): Withdraw up to $60,000 tax-free from your RRSP to put toward your first down payment.

Setting Your Budget & Mortgage Pre-Approval

Before searching for homes, first-time buyers should determine affordability. A good rule of thumb: your monthly housing costs (mortgage, taxes, insurance) should not exceed 30–35% of your income.

- Mortgage Pre-Approval: Essential to know what lenders will approve and to strengthen your offer in Toronto’s competitive market.

- Down Payment: Minimum 5% on homes under $500,000; 10% for the portion between $500,000 and $999,999; 20% for homes above $1M.

- Closing Costs: Budget at least 3–5% of purchase price for land transfer taxes, legal fees, and inspections.

Choosing the Right Property Type

First-time buyers often start with condos, but the right property depends on your lifestyle and budget:

- Condos: Affordable, low-maintenance, and great for professionals. Browse condos for sale Toronto.

- Townhomes: Offer more space and often have outdoor areas—popular in Mississauga and Vaughan.

- Detached Homes: Rare for first-time buyers in Toronto proper, but achievable in house for sale in Brampton or house for sale in Milton.

Best Neighborhoods for First-Time Buyers in Toronto & GTA

Here are some top picks for affordable and accessible first homes:

- Toronto East: Danforth Village, Scarborough, and East York offer relatively lower condo and townhouse prices.

- Mississauga: Strong condo market and easy access to Toronto via GO Transit. Explore Mississauga homes for sale.

- Brampton: Affordable detached and semi-detached homes, perfect for young families.

- Vaughan: Growing condo and townhome developments near the subway extension.

The Home Buying Process Step-by-Step

- Work with a trusted realtor who understands first-time buyers.

- Get mortgage pre-approval and set a budget.

- View homes online and in person (MLS is your best friend).

- Make an offer—include conditions like financing and inspection when possible.

- Conduct a home inspection to avoid surprises.

- Close the deal—sign paperwork, transfer funds, and get your keys!

Common Mistakes First-Time Buyers Should Avoid

- Skipping mortgage pre-approval and being surprised by financing limits.

- Stretching the budget too far and ignoring monthly affordability.

- Forgetting about closing costs and moving expenses.

- Buying in a rush without comparing neighborhoods.

Tips for a Smooth Buying Journey

- Start saving early and consider setting up a First Home Savings Account (FHSA).

- Stay flexible—your first home may not be your forever home.

- Use professional advice from mortgage brokers and realtors.

- Attend open houses to learn market trends firsthand.

- Download our first-time home buyer guide PDF for a step-by-step checklist.

Conclusion

Buying your first home in Toronto may seem daunting, but with the right plan and support, it’s more achievable than you think. From government incentives to budget-friendly neighborhoods, there are many ways to make the dream of homeownership a reality in 2025.

Whether you’re considering a downtown condo or a family-friendly townhouse in the GTA, Team Sapphire is here to guide you every step of the way.

Frequently Asked Questions

1. How much do I need for a down payment in Toronto?

You need at least 5% of the purchase price for homes under $500,000, with higher minimums for more expensive properties.

2. What is the average price of a condo in Toronto in 2025?

Entry-level condos in downtown Toronto average around $650,000, while Scarborough and North York may offer options in the $500,000s.

3. Are detached homes realistic for first-time buyers in Toronto?

Detached homes in Toronto proper are challenging for first-time buyers, but more affordable options exist in areas like Milton, Oshawa, and Hamilton.

4. What incentives are available for first-time buyers in Ontario?

Programs include the First-Time Home Buyer Incentive, Land Transfer Tax rebates, RRSP Home Buyers’ Plan, and tax credits.

5. Should I buy in Toronto or the surrounding GTA?

If budget is tight, surrounding GTA cities like Brampton, Vaughan, and Mississauga often offer better value while still providing easy access to Toronto.

Categories

Recent Posts