Toronto First-Time Buyer Incentives Explained (2025 Edition)

Toronto First-Time Buyer Incentives Explained (2025 Edition)

Key Takeaways

- First-time buyers in Toronto can save thousands with federal and provincial incentives.

- Programs include the Home Buyers’ Plan (HBP), First-Time Home Buyer Incentive, and land transfer tax rebates.

- Toronto has both Ontario and municipal land transfer taxes, making rebates extra valuable.

- New savings options like the FHSA make down payments more achievable.

- Combining programs helps maximize affordability for your first home purchase.

Introduction

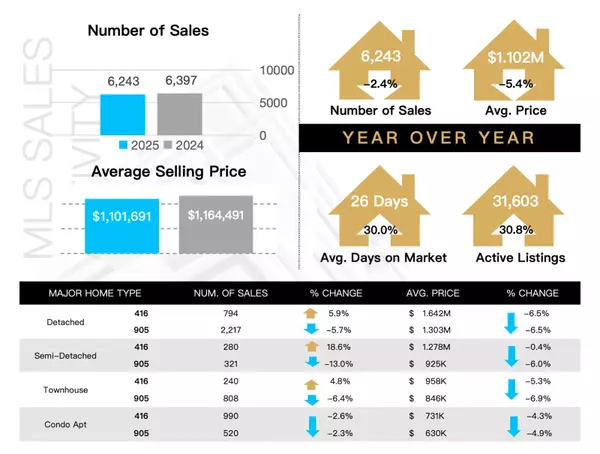

Buying your first home in Toronto is a major financial step. With average condo prices hovering in the $600,000–$700,000 range, incentives can make a real difference. In 2025, both federal and provincial governments are offering rebates, credits, and programs designed to help first-time buyers step into homeownership.

In this guide, we’ll explain each program, who qualifies, and how much you could save on your first property in Toronto or the GTA.

👉 For the full step-by-step guide, see our Toronto First-Time Home Buyer Guide 2025.

Federal Incentives for First-Time Buyers

The Canadian government offers multiple programs to reduce the upfront costs of buying your first home.

1. First-Time Home Buyer Incentive (FTHBI)

- The government contributes 5% (resale homes) or 5–10% (new builds) toward your down payment.

- It’s a shared equity program—you repay when you sell the home or after 25 years.

- For a $600,000 condo in Toronto, this could mean $30,000 off your mortgage amount. Check out current condos for sale Toronto to see what fits your budget.

2. RRSP Home Buyers’ Plan (HBP)

- Withdraw up to $60,000 from your RRSP without immediate tax penalties.

- You have 15 years to repay the amount to your RRSP.

- Perfect for buyers who have built retirement savings but need cash for a down payment.

3. First-Time Home Buyers’ Tax Credit (HBTC)

- Tax credit of up to $1,500 for eligible buyers.

- Claimed when you file your taxes in the year of purchase.

Ontario & Toronto Buyer Rebates

In addition to federal programs, Ontario and the City of Toronto both offer land transfer tax rebates. Since Toronto has two separate land transfer taxes (provincial + municipal), this is a huge savings opportunity.

- Ontario Rebate: Save up to $4,000 on land transfer tax.

- Toronto Rebate: Save up to $4,475 on the municipal portion.

Combined, first-time buyers in Toronto can save up to $8,475 in land transfer taxes. That’s money you can put toward moving costs or furnishing your new home. If you’re considering nearby areas like houses for sale in Mississauga, land transfer tax rebates still apply (though only the provincial portion).

First Home Savings Account (FHSA)

Introduced in 2023, the FHSA is a powerful new tool for first-time buyers:

- Contribute up to $8,000 per year (lifetime max $40,000).

- Contributions are tax-deductible (like an RRSP).

- Withdrawals for a qualifying home purchase are tax-free (like a TFSA).

For first-time buyers who are still saving up for a down payment, this account offers the best of both tax worlds.

Can You Combine Incentives?

Yes! Most programs can be combined to maximize affordability. For example:

- Use the FHSA + HBP to build your down payment.

- Apply the First-Time Home Buyer Incentive to reduce your mortgage.

- Claim the HBTC and land transfer tax rebates to lower closing costs.

With the right planning, first-time buyers in Toronto can save tens of thousands of dollars. If you’re exploring more affordable markets, browse a house for sale in Brampton or house for sale in Hamilton where incentives stretch even further.

Who Qualifies for First-Time Buyer Incentives?

General eligibility requirements include:

- You have not owned a home in the last 4 years (or lived in a spouse’s owned home).

- You are a Canadian citizen or permanent resident.

- The property will be your primary residence (not a rental or investment).

- For the FTHBI, household income must generally be under $120,000–$150,000 depending on region.

How to Apply for Incentives

Applying for incentives usually involves working with your lender and lawyer during the buying process:

- Speak with your mortgage broker or bank about using FTHBI and HBP.

- Your real estate lawyer will apply the land transfer tax rebates at closing.

- Claim the HBTC when you file your taxes for the purchase year.

- Open and contribute to an FHSA before your purchase for maximum benefit.

👉 Need help calculating your budget with incentives? Read our free home valuation guide or our upcoming budgeting cluster blog.

Conclusion

Buying your first home in Toronto can feel financially out of reach—but with incentives and rebates, it becomes more achievable. By combining federal, provincial, and municipal programs, first-time buyers can save thousands and reduce the stress of closing costs.

Don’t forget, this is just one part of the journey. For the complete roadmap, check out our Toronto First-Time Home Buyer Guide 2025.

Frequently Asked Questions

1. Can I use both the FHSA and the RRSP Home Buyers’ Plan?

Yes, you can use both together to maximize your down payment savings.

2. How much can I save with land transfer tax rebates in Toronto?

First-time buyers can save up to $8,475 combined from Ontario and Toronto rebates.

3. Do I need to repay the First-Time Home Buyer Incentive?

Yes, since it’s a shared equity program, repayment is required when you sell your home or after 25 years.

4. Can newcomers to Canada qualify for incentives?

Yes, permanent residents and Canadian citizens are eligible, provided they meet other requirements.

5. What’s the best incentive for saving up for a down payment?

The FHSA is the strongest tool for saving tax-efficiently before your purchase.

Categories

Recent Posts