Steps for Young Professionals Renting in Toronto to Buy Their First Condo

For young professionals renting in Toronto, buying a first condo can feel out of reach. Between rising prices, low inventory, and high rents, many wonder if they’ll ever save enough for a down payment. The good news: with a clear plan, smart savings strategies, and the right resources, buying your first condo in Toronto and the Greater Toronto Area (GTA) is absolutely possible.

This guide walks you through practical steps to go from renter to first-time condo owner in Toronto, Etobicoke, Mississauga, Vaughan, Richmond Hill, Brampton, and nearby cities like Pickering and Newmarket.

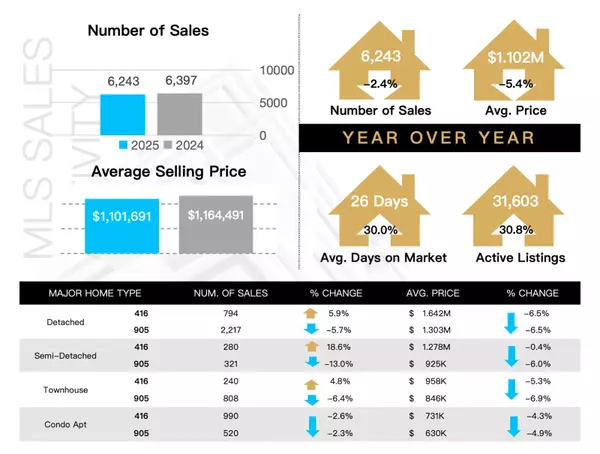

Understanding the Current Condo Market in Toronto

Rising Condo Prices Across the GTA

In the Greater Toronto Area, including hubs like Etobicoke, Mississauga, and Vaughan, condo prices have been climbing steadily. Recent data shows average condo prices rising around 8% over the past year in many parts of the region.

What this means for young professionals:

- Waiting too long can make buying more expensive.

- The sooner you start planning and saving, the better you can keep up with price growth.

- Focusing on a realistic price range and area is crucial.

Low Inventory in Popular Neighbourhoods

High-demand areas in the GTA often face low inventory and strong competition:

- In Richmond Hill and Brampton, condos can sell quickly and sometimes receive multiple offers.

- Well-located, well-priced units don’t stay on the market long.

- First-time buyers without a clear budget, savings plan, or mortgage pre-approval may struggle to compete.

To stand out, you’ll need:

- A solid down payment strategy

- A pre-approval letter

- Flexibility on unit size, features, or location

Why Saving for a Down Payment Matters

Saving for a down payment is one of the most important steps to buying your first condo in Toronto.

A larger down payment can help you:

- Borrow less from the bank, reducing your long-term interest costs.

- Lower your monthly mortgage payments, making ownership more affordable.

- Access better mortgage rates, since lenders see you as lower risk.

- Strengthen your offer in a competitive market, as sellers often prefer buyers with stronger financial positions.

A common benchmark is 20% of the condo price, though Canada allows for lower minimum down payments on many properties. Still, aiming higher gives you more flexibility and reduces the need for mortgage insurance.

Creating a Realistic Savings Plan

Step 1: Track Your Current Expenses

Start by understanding exactly where your money goes each month:

- Rent and utilities

- Transportation (public transit, Uber, gas, parking)

- Groceries and eating out

- Subscriptions (streaming, apps, gym)

- Entertainment and shopping

- Debt payments (credit cards, student loans, car loans)

Use a simple spreadsheet, budgeting app, or your banking app’s insights. Once you see your full spending picture, you can identify areas to cut back and redirect toward your condo savings fund.

Step 2: Set a Clear Savings Goal

Use realistic numbers based on current condo prices in your target area.

Example:

- Average condo price in your preferred GTA area: $500,000

- Target down payment (20%):

Your goal: save $100,000 for a 20% down payment.

If prices in emerging areas like Pickering or Newmarket are lower, you can adjust the target. The key is to pick a number and build your plan around it.

Step 3: Break It Into Monthly Targets

Decide when you’d like to buy and work backwards.

Example (5-year plan):

- Total savings goal: $100,000

- Timeframe: 5 years = 60 months

- Monthly savings needed:

If that monthly amount seems too high:

- Extend your timeline (e.g., 6–7 years instead of 5), or

- Target a lower-priced condo or area, or

- Look at ways to significantly reduce expenses or increase income (overtime, side gigs, promotions, bonus savings).

Smart Saving Strategies for Toronto Renters

Open a Dedicated Condo Savings Account

Keep your condo savings completely separate from your everyday spending.

- Use a high-interest savings account or other low-risk savings vehicles.

- Nickname the account “First Condo Fund” to keep your goal top-of-mind.

- Avoid using this account for vacations, big purchases, or emergencies (those should ideally have their own funds).

Reduce Non-Essential Spending

Small cuts can make a big difference over several years:

- Limit dining out and takeout; cook more at home.

- Cancel unused subscriptions and memberships.

- Set a monthly cap for entertainment and shopping.

- Look for cheaper phone, internet, or insurance plans.

- Consider a roommate or slightly smaller rental to lower monthly rent and free up extra savings.

Revisit your budget every few months and increase savings whenever your income rises.

Automate Your Savings

Treat your condo savings like a non-negotiable bill:

- Set up automatic transfers from your main account to your condo savings the day after payday.

- Automating removes willpower from the equation and makes consistent saving much easier.

- Increase the transfer amount gradually as your income grows or expenses drop.

Leveraging Government Programs for First-Time Home Buyers

As a first-time buyer in Ontario, you may qualify for several programs that can reduce your upfront costs.

First-Time Home Buyer Incentives

Look into programs such as:

- Federal First-Time Home Buyer Incentive – offers shared-equity loans to reduce your mortgage payments.

- RRSP Home Buyers’ Plan (HBP) – lets you withdraw from your RRSP (up to certain limits) for a down payment, if eligible.

- Ontario land transfer tax rebates for first-time home buyers, which can reduce closing costs.

These incentives can:

- Lower the amount you need to save in cash.

- Make your first purchase more manageable.

- Free up funds for closing costs, furnishings, or renovations.

Always double-check the latest details and eligibility criteria with your lender, REALTOR®, or a mortgage broker, since programs can change.

Preparing for Mortgage Approval

Understand and Improve Your Credit Score

Your credit score plays a major role in:

- The mortgage rate you’re offered

- How much you can borrow

- Whether you’re approved at all

Steps to improve or maintain a strong score:

- Pay all bills on time, every month.

- Keep credit card balances low, ideally under 30% of your limit.

- Avoid opening multiple new credit accounts right before applying.

- Check your credit report for errors and dispute anything inaccurate.

A higher score can translate into lower interest costs over the life of your mortgage, which is significant.

Get Pre-Approved Before You Shop

A mortgage pre-approval gives you:

- A clear budget for your condo search

- An idea of your expected mortgage rate and payments

- More credibility in the eyes of sellers and real estate agents

In competitive GTA markets like Mississauga, Vaughan, or Etobicoke, pre-approval can help your offer stand out, especially if there are multiple buyers.

Choosing the Right Location in the GTA

Explore Emerging and More Affordable Areas

While central Toronto and hot spots like some parts of Etobicoke or downtown Mississauga can be expensive and competitive, emerging areas may offer better value:

- Pickering – Good GO train access and growing development.

- Newmarket – Quieter setting with more space, while still within commuting distance.

- Parts of Brampton, Richmond Hill, or Vaughan – Certain pockets may offer more reasonable prices than others.

Things to consider:

- Commute time to work or major transit lines

- Access to amenities (groceries, gyms, parks, schools)

- Safety and community feel

- Condo fees and building management quality

Consider Future Growth and Long-Term Value

Look for areas with:

- Planned transit expansions

- New infrastructure projects

- Upcoming retail, commercial, or residential developments

These can support future price appreciation, turning your first condo not just into a home but also a solid long-term investment.

Additional Tips for First-Time Condo Buyers in Toronto

- Work with a knowledgeable REALTOR® who understands first-time buyers and GTA condo markets.

- Compare multiple lenders or use a mortgage broker to find the best rates and terms.

- Budget for closing costs (legal fees, land transfer tax, inspections, etc.), typically a few percent of the purchase price.

- Review condo documents (status certificate, reserve fund, rules) carefully to avoid surprises on fees or restrictions.

Final Thoughts: From Renter to Condo Owner in Toronto

For young professionals renting in Toronto, buying a first condo is a big step—but it’s achievable with the right strategy:

- Understand the current GTA condo market and set realistic expectations.

- Build a structured savings plan with a clear down payment goal.

- Use smart saving tactics, automation, and possible government incentives.

- Strengthen your credit profile and secure a pre-approval.

- Stay flexible on location, exploring both popular and emerging areas across the GTA.

It may take time, discipline, and trade-offs, but each month of focused saving and planning moves you closer to your goal. Whether you end up in a lively neighbourhood in Etobicoke or a quieter community in Newmarket or Pickering, your first home in the GTA is within reach with a clear plan and consistent action.

Categories

Recent Posts