Condo vs. Freehold in Toronto: Which Is the Better Investment in 2025?

Condo vs. Freehold in Toronto: Which Is the Better Investment in 2025?

Meta Description: Dive into a detailed comparison of Toronto condo vs freehold properties in 2025. Discover which offers better returns, more stability, and smarter long-term value based on the latest real estate data from May and June 2025.

Introduction

Toronto’s real estate market is undergoing another wave of transformation in 2025, and investors are once again asking the all-important question: Should I invest in a condo or a freehold property? With high interest rates, shifting migration trends, and evolving buyer preferences, making the right decision could mean the difference between strong returns and stagnant growth.

Using the latest data from May and June 2025, we’ll break down the current investment landscape, highlight key market differences, and help you determine the best real estate strategy moving forward.

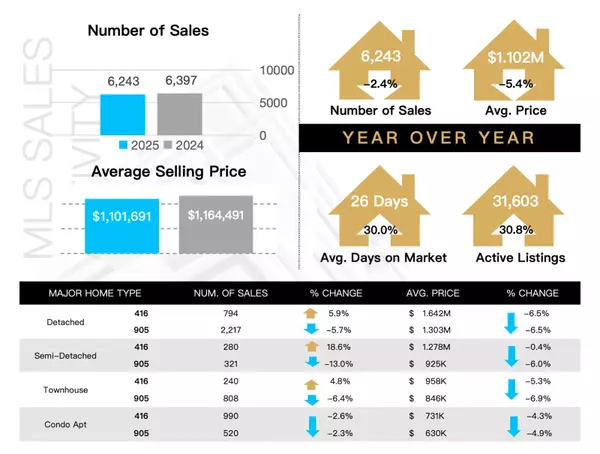

Toronto Real Estate Snapshot: May–June 2025

-

Average Condo Price: $702,000

↳ Down 7% year-over-year -

Average Freehold Price: $1.33 million

↳ Down 6% year-over-year -

Months of Inventory (MOI):

↳ Condos: 7.2 MOI (buyer’s market)

↳ Freeholds: 4.3 MOI (balanced market)

This data reveals a cooling condo market marked by high supply and price pressure, while freehold homes remain comparatively more stable.

Condos in 2025: Pros & Cons

Pros:

-

Lower entry price: Still the most affordable option in the city.

-

More available options: High inventory means buyers have bargaining power.

-

Ideal for first-time buyers or downsizers looking for low maintenance.

Cons:

-

Oversupply risk: Many new units entering the market.

-

Lower resale appreciation: Especially for smaller or investor-oriented units.

-

Vacancy rate increases: More listings means more competition in rental markets.

Freehold Properties in 2025: Pros & Cons

Pros:

-

Stronger long-term appreciation: Especially in prime neighborhoods.

-

Higher land value component: Less affected by short-term oversupply.

-

Lower inventory: Keeps values steadier in a cooling market.

Cons:

-

Higher upfront cost: Entry point remains steep.

-

Maintenance responsibility: Owners shoulder full upkeep.

-

Harder financing: With elevated interest rates, securing a mortgage for freehold can be more complex.

The Submarket Breakdown

Condos: Not All Units Are Equal

Premium or larger condos in central locations still command interest and sales. In contrast, small, investor-oriented units in high-rise buildings are struggling. Buyers today want livable space, not shoebox studios.

Freehold Homes: Prime Locations Rule

In-demand areas like Leslieville, The Annex, and High Park continue to outperform suburbs or satellite towns. While outer suburbs are seeing softening prices, inner-core freeholds are holding value.

Rental Market & Cash Flow Outlook

The average Toronto rent as of June 2025 is around $2,606/month, a 7% drop from last year. Both condo and freehold investors are seeing tighter margins, but condos are under more pressure due to the sharp rent declines and rising maintenance fees.

Freeholds may offer more flexibility in adding secondary suites, increasing potential income and boosting long-term cash flow sustainability.

Who's Buying What in 2025?

-

Investors are more cautious, often opting for value-add freeholds over condos.

-

First-time buyers are targeting condos due to price, but are prioritizing layout and location more than ever.

-

End-users and families prefer freeholds for space, schools, and stability.

What the Experts Predict

-

Condos will continue to face downward price pressure unless inventory tightens.

-

Freeholds in prime areas may see mild appreciation or at least price stability by the end of 2025.

-

Investors are advised to focus on livable space, location, and long-term value, whether choosing condo or freehold.

Conclusion: Which is the Better Investment in 2025?

If your goal is long-term growth and stability, freehold homes in prime areas remain the better choice, even with higher upfront costs. If your focus is affordability and entry-point access, larger well-located condos with good floor plans may still provide solid opportunities.

Ultimately, the better investment depends on your strategy, risk profile, and time horizon. With Toronto’s real estate in flux, the smartest move is to work with a professional who understands the nuances of each submarket.

Ready to Make a Move?

For personalized investment advice, market analysis, or property tours, contact:

Mahesh Khatri

📞 Phone: +1 (416) 464-6568

🌐 Website: www.teamsapphire.ca

Your smarter real estate investment starts here.

Categories

Recent Posts