"First-Time Homebuyer's Guide to the GTA: Where to Start"

Title: First-Time Homebuyer's Guide to the GTA: Where to Start

Title: First-Time Homebuyer's Guide to the GTA: Where to Start

Introduction:

Buying your first home in the Greater Toronto Area (GTA) can be an exciting yet daunting experience. With its diverse neighborhoods, dynamic real estate market, and array of housing options, the GTA offers something for every aspiring homeowner. This guide will walk you through the essential steps to start your journey towards homeownership in one of Canada's most vibrant regions.

- Assess Your Financial Readiness:

Before diving into the GTA's real estate market, it's crucial to evaluate your financial situation:

a) Credit Score: Check your credit score and work on improving it if necessary. A higher score can help you secure better mortgage rates.

b) Savings: Determine how much you've saved for a down payment. In Canada, you'll need a minimum of 5% for homes under $500,000, with the percentage increasing for more expensive properties.

c) Debt-to-Income Ratio: Calculate your debt-to-income ratio to ensure you can comfortably afford mortgage payments alongside your other financial obligations.

d) Additional Costs: Factor in closing costs, property taxes, maintenance, and potential renovation expenses.

- Get Pre-Approved for a Mortgage:

Obtaining a mortgage pre-approval is a crucial step:

a) Shop Around: Compare rates and terms from different lenders to find the best deal.

b) Gather Documents: Prepare necessary documentation, including proof of income, employment verification, and bank statements.

c) Understand Your Budget: A pre-approval will give you a clear idea of how much you can afford, helping you focus your home search.

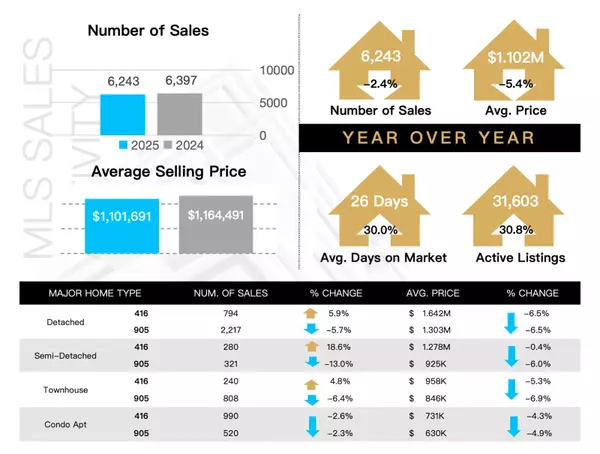

- Familiarize Yourself with the GTA Real Estate Market:

The GTA comprises various regions, each with its unique characteristics:

a) Toronto: The heart of the GTA, offering urban living with diverse neighborhoods. b) York Region: Including cities like Markham, Richmond Hill, and Vaughan, known for family-friendly communities. c) Peel Region: Home to Mississauga and Brampton, offering a mix of urban and suburban living. d) Durham Region: Eastern GTA, including cities like Oshawa and Ajax, often more affordable than central areas. e) Halton Region: Western GTA, including Oakville and Milton, known for its blend of urban and natural spaces.

Research these areas to understand price trends, amenities, and lifestyle offerings that align with your preferences.

- Define Your Must-Haves and Nice-to-Haves:

Create a list of features you need in your first home:

a) Property Type: Decide between detached homes, semi-detached, townhouses, or condos. b) Size: Determine the number of bedrooms and bathrooms you require. c) Location: Consider proximity to work, public transit, schools, and amenities. d) Special Features: Think about aspects like a home office, outdoor space, or parking.

- Hire a Real Estate Agent:

A knowledgeable local agent can be invaluable:

a) Market Insight: They can provide in-depth knowledge about different GTA neighborhoods. b) Negotiation Skills: Agents can help you navigate offers and counteroffers. c) Access to Listings: They can show you properties that might not be widely advertised. d) Paperwork Management: Agents assist with the complex documentation involved in home buying.

- Start Your Home Search:

With your agent's help, begin exploring properties:

a) Online Research: Use real estate websites to get a feel for what's available in your price range. b) Open Houses: Attend open houses to see properties in person and get a sense of different neighborhoods. c) Private Showings: Schedule viewings for properties that match your criteria.

- Understanding the Offer Process:

When you find a home you like, it's time to make an offer:

a) Offer Price: Your agent will help you determine a competitive offer based on market conditions and the property's value. b) Conditions: Consider including conditions like a home inspection or financing approval. c) Deposit: Be prepared to provide a deposit with your offer, typically 5% of the purchase price.

- Home Inspection and Appraisal:

Once your offer is accepted:

a) Home Inspection: Hire a professional inspector to assess the property's condition. b) Appraisal: Your lender may require an appraisal to ensure the property's value aligns with the mortgage amount.

- Closing the Deal:

The final steps in your home-buying journey:

a) Lawyer: Hire a real estate lawyer to review all documents and handle the legal aspects of the purchase. b) Insurance: Secure home insurance, which is required to finalize your mortgage. c) Final Walkthrough: Do a final inspection of the property before closing. d) Closing Day: Sign the necessary paperwork and receive the keys to your new home.

- First-Time Homebuyer Incentives:

Take advantage of programs designed to help first-time buyers:

a) First-Time Home Buyers' Tax Credit: A $5,000 non-refundable income tax credit. b) Home Buyers' Plan (HBP): Allows you to withdraw up to $35,000 from your RRSP for a down payment. c) Land Transfer Tax Rebate: First-time buyers in Toronto may be eligible for a rebate of up to $4,475.

- Neighborhood Spotlight: Emerging Areas for First-Time Buyers

While established neighborhoods in the GTA can be pricey, several up-and-coming areas offer great potential for first-time buyers:

a) Mimico (Toronto): This lakefront community in Etobicoke offers a mix of condos and houses with easy access to downtown.

b) Regent Park (Toronto): Once known for its social housing, this revitalized neighborhood now offers modern condos and amenities.

c) Pickering (Durham Region): With new developments and proximity to Toronto, Pickering is becoming increasingly popular.

d) Milton (Halton Region): This fast-growing town offers more affordable housing options and a family-friendly atmosphere.

e) Stouffville (York Region): This charming town provides a blend of rural and urban living, with new developments attracting first-time buyers.

Conclusion:

Buying your first home in the GTA is a significant milestone that requires careful planning and consideration. By following this guide, you'll be well-prepared to navigate the complexities of the GTA real estate market. Remember, every homebuying journey is unique, so don't hesitate to seek advice from professionals and take the time to find the right home for you.

The GTA offers a wealth of opportunities for first-time homebuyers, from bustling urban centers to quiet suburban neighborhoods. With proper preparation, realistic expectations, and the right support team, you'll be well on your way to finding your perfect first home in this diverse and exciting region.

Categories

Recent Posts